企业绩效管理

1. CSFs: Critical success factors --Vital areas 'where things must go right' for the business.

关键成功因素-- 对于企业来说,关键领域是“事情必须进展顺利”的地方。

Steps of measurement:

Selecting KPIs --Collecting data –Calculating-- Interpreting results

2. KPIs: Key performance indicators --Indicators that are used to quantify performance.

关键绩效指标--用于量化绩效的指标。

Performance management can be defined as any activity designed to ensure that its goals are being met and to improve an organisation's performance.

绩效管理可以定义为任何旨在确保实现其目标并提高组织绩效的活动。

Performance management systems are the systems in an organisation by which theperformance of an organisation is measured, controlled and improved.

绩效管理系统是组织中衡量、控制和改进组织绩效的系统。

Benefits of performance measures 绩效指标的好处

Objectives Clarify -the objectives of the organisation

Measures- What gets measured, gets done

Targets -Facilitate the setting of targets for the organisation and its managers

Comparison-Facilitate comparison of performance in different organisation

Accountability- Promote accountability of the organisation to its stakeholders

Performance measurement system (PMS)

--Mission

-CSFs: Vital areas 'where things must go right' for the business.

-KPIs: Indicators that are used to quantify performance.

Performance measurement and behavioural issues 绩效指标和行为问题

Tunnel vision- Undue focusing on the aspects of performance being measured to the detriment of other aspects of performance. This is caused by the poorly developed performance measurement system.

Myopia- KPIs focusing on short-term success or goals at the expense of longer-term objectives and long-term success. This is also a problem of the performance measurement system.It could lead to suboptimal decisions made by the managers.

Gaming- Deliberate distortion of performance to secure some strategic advantage. This is relatedwith what is rewarded/reported, not because of what is being measured.

Ossification- An overly rigid system, or an unwillingness to change the performance measure schemeonce it has been set up.

Behaviouralissues Solutions:

Tunnel vision All aspects of the strategic objectives should be measured.

Myopia The use of longer term measures rather than those over just one accountingperiod might help to capture the effect of such behaviour

Gaming 1. A culture of honesty in the organisation.

2. The manager is rewarded for average gains over long periods rather thanblock payments for hitting simple profit-triggers in a single period.

Ossification 1. The CEO will need to persuade BOD that there are issues in the omissions from the current set of performance measures which will lead to long-term difficulties in achieving their overall goal of enhancing shareholder wealth.

2. The board is rewarded if current good performance is sustainable in thefuture.

3 BSC:Balanced Scorecard --A tool to translate an organisation's vision and strategy into objectives and measures.

平衡记分卡--将组织愿景和战略转化为目标和措施的工具

Benefits of BSC-The Balanced Scorecard (平衡记分卡)

To achieve organization's objectives with an effective measurement system.

To develop measures linking lower level management with higher level management →Goal congruence.

Using both internal information and external information.

Using both financial information and non-financial information.

Problems ofimplementingand using BSC

Selecting measures:

• Some aspects of the business may be harder to measure than others → If not measured, not done.

• Measures selected should not just because they are easy to measure → Not linked to objectives?

• Measures chosen may incur conflicts.• Should have financial and non-financial measures

• Should cover internal and external factors (e.g.Stakeholder interests).

• Stakeholders value different issues, so prioritising measures will be difficult.• Care must be taken to avoid overloading with toomany performance measures.

• Number of KPIs should be balanced.

Interpreting data:

• Customer survey difficult to interpret .

• Taking time and resources to collect data → staff training & IS development → Costs should becompared to the benefits of doing so.

4. The SWOT analysis

It can be used to identify the extent to which the organization has managedto obtain a fit with its environment and can suggest possible strategies to close theperformance gap.

SWOT分析可用于确定组织在多大程度上管理以适应其环境,并可提出缩小绩效差距的可能策略。

S-O strategies pursue opportunities that are a good fit to the organization's strengths.

W-O strategies overcome weaknesses to pursue opportunities.

S-T strategies identify ways in which the organization can use its strengths to reduce itsvulnerability to external threats.

W-T strategies establish a defensive plan to prevent the organisation's weaknesses frommaking it highly-susceptible to external threats.

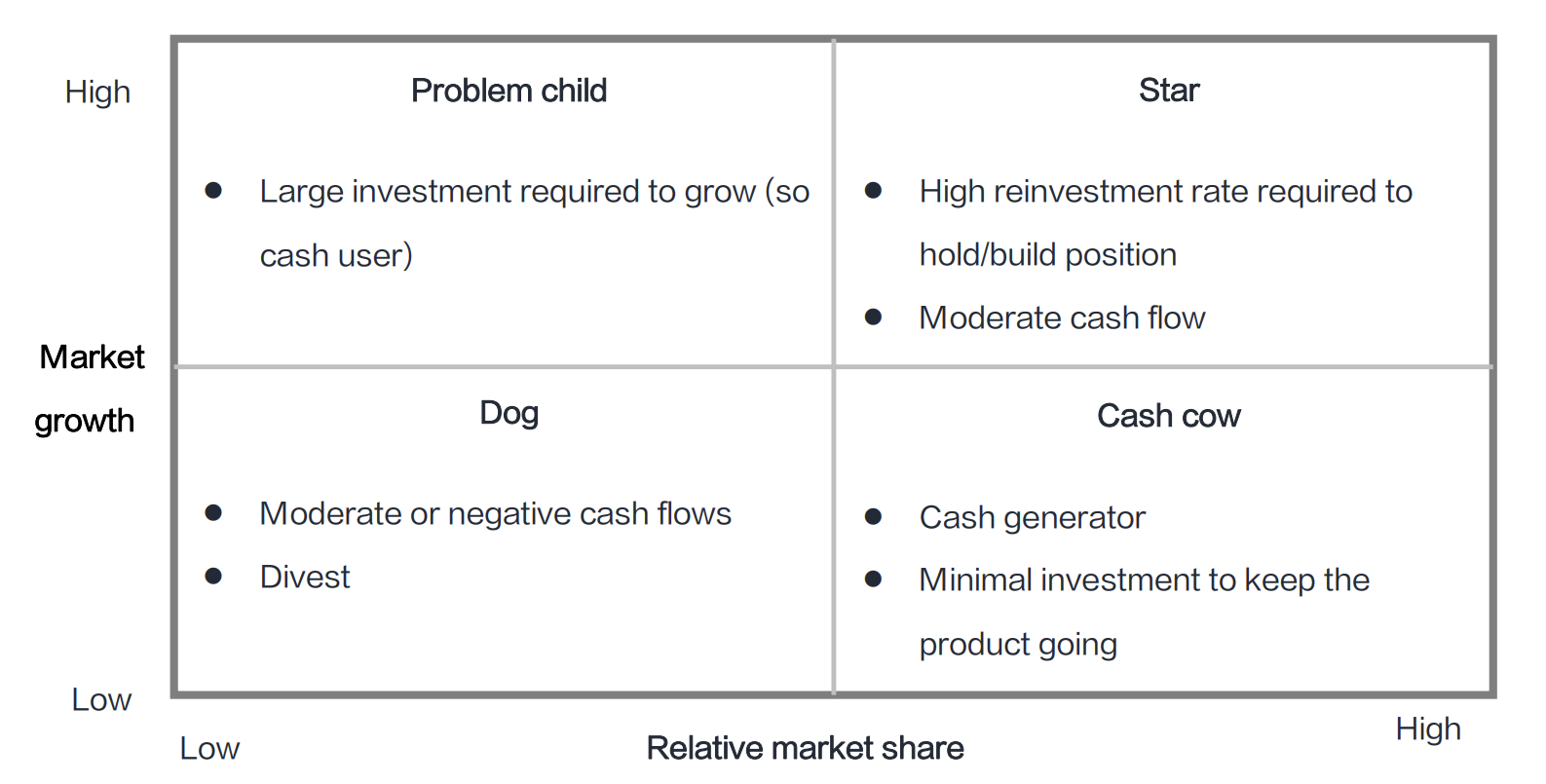

5. BCG matrix 波士顿矩阵

Problems of BCG model

A strategic analysis tool, not for performance measurement (not measuring the achievement of company's objectives)

Only one cash cow or star in the whole market business profile may not always bebalanced

Difficult to locate divisions to the quadrants Not reflecting relationships between divisions (e.g. Dog supporting other divisions?)

Not planning and monitoring performance of different products in one division

6. Porter's generic strategies--波特的一般策略

A very important determinant of a firm's profitability is its position within that industry.一家公司盈利能力的一个非常重要的决定因素是它在该行业中的地位

Porter's generic strategies help identify which market to compete in, i.e., to compete with whom.

Advantage Target scopeLow cost Product uniquenessBroad (industry wide) Cost leadership strategyProduct differentiationstrategyNarrow (market segment) Focus strategy Focus strategy

7. PEST

8. Porter's five force--波特五力

-

是迈克尔•波特(Michael Porter)于20世纪80年代初提出,它认为行业中存在着决定竞争规模和程度的五种力量,这五种力量综合起来影响着产业的吸引力以及现有企业的竞争战略决策。

Porter's five forces model focuses on the competitive nature of an industry and therefore attractiveness of a market.

Attractiveness in this context refers to the overall industry profitability. They consist of forces which affect a company's ability to serve its customers and make a profit. A change in any of these forces normally would require a company to reassess the marketplace.

Porter claimed that there are five "competitive forces" affecting every industry and that, in most, some force other than rivalry has the greatest impact on the levels of margin earned:

1. Threat from new entrants 潜在竞争者进入的能力, % of revenue from products protected by patents R& D expenditure, R* D period , entry cost.

2. Suppliers bargaining power 供应商的讨价还价能力, Number of suppliers, materials cost/total cost %, Switching costs

3. Competitive rivalry .同行业内现有竞争者的竞争能力, Market share, R&D leadership, Average product launched time compared with competitors

4. Buyers bargaining power 购买者的讨价还价能力, Number of buyers, % revenue generated from those customers

5. Threat from Substitutes.替代品的替代能力, Relative price/ performance of substitutes, growth ratesof substitute markets.

9. Activity-Based-Budget (ABB)基于活动的预算

A method of budgeting based on an activity framework and utilizing cost driver data in thebudget-setting and variance feedback processes.

基于活动的预算(ABB)一种基于活动框架并在预算设置和差异反馈过程中利用成本驱动因素数据的预算编制方法。

Advantage:

• Important where overhead costs are alarge proportion of total operational costs.

• Useful in complex productionenvironment.

• Useful to control costs by understandingcost drivers.

• Removing non-value-adding activities.

• Improving value-adding activities.

Disadvantage:

• Complex.

• May not be appropriate for all organisations

• e.g. low O/Hs %, simple production.

• In the short-term, many overhead costs arenot variable or controllable with cost drivers.

• IS and training in need, but costly.

• Staff resistance.

• Difficult to identify activities and cost drivers.

10. Zero-Based-BudgetZBB 零基预算

ZBB is a 'method of budgeting that requires each cost element to be specifically justified, asthough the activities to which the budget relates were being undertaken for the first time.Without approval, the budget allowance is zero.’

ZBB是一种“预算编制方法,要求每个成本要素都有明确的理由,即使预算所涉及的活动是第一次进行的。未经批准,预算津贴为零

Advantage

• Wasteful expenditure is avoided.

• Inefficient or obsolete operations can be identifiedand discontinued.

• Attention is focused on outputs in relation to value formoney.

• Creates a culture of questioning the value of activitiesrather than one which assumes current practicesrepresent value for money.

• Increased staff involvement at all levels, andtherefore may lead to better communication andmotivation.

• Resources should be allocated efficiently andeconomically.

Disadvantage

• Time consuming

• Short-termism

• Management skills neededmay not be present

• Threatening?

• Ranking of packages maybe subjective where thebenefits are of a qualitativenature.

• Too rigid to react tounforeseen opportunitiesor threats?

11 VBM (Value-based management) 以价值为基础的管理

VBM begins from the idea that value is only created when companies generate returns which beat their cost of that capital.

It measures the value of a company with its discounted future cash flows (e.g. EVA).

VBM then focuses the management of the company on those areas which create value.

Implementation of VBM :

A strategy is developed to maximise value.

Key value drivers must be identified and then performance targets set

A plan is developed to achieve the targets.

Performance metrics and reward systems are created compatible with these targets.

VBM-Pros

1 Focusing on value as opposed to profit, so reducing the tendency to make decisions whichhave positive short-term impact but may be detrimental in the long term

2 Making companies more forward looking.

3. Closer to a cash flow measure of performance which is less affected by the variousaccounting adjustments

VBM-Cons

1 Unfamiliarity and complexity of the calculation. This difficulty can be overcome by aprocess of education and training for the staff and shareholders.

2 It might become an exercise in valuing everything but changing nothing. It is important thatthe detailed operational issues of the organisation are addressed through the newmeasures/targets.

3 The measurement of the key value drivers can often involve non-financial indicators andthese can represent a significant change for accounting-based management informationsystems.

4 Overlook other value drivers, only focusing on drivers in the calculation formula.

5 Cost of capital is calculated using historical data, not repeated in the future.

6 Still, it drives managers to choose projects with low initial costs to provide a short -termboost to the value measure in the same way as profit measures.

12. ABM-Activity based management (ABM)基于活动的管理

applies activity-based costing (ABC) principles in order to satisfy customer needs using the least amount of resources.

ABC: Divide inventory items into three levels: particularly important inventory (Class A), generally important inventory (Class B), and unimportant inventory (Class C) based on their variety and amount of capital occupied. Then, manage and control each level separately,

ABC分类:货物价值和库存周转率-库存物品按品种和占用资金分别进行管理与控制

A类物料最为重要,约占总物料的10%;

B类物料次之,约占总物料的20%;

C类物料再次之,约占总物料70%。

Strategic ABM (SABM)

Do right things:做正确的事情

• PPA – Uses ABC info to decide which products to develop or discontinue →Allocate resources, such as capital investment, to the most profitable lines of business.

• CPA – Uses ABC info to decide which customers are the most profitable → focuses more on them.

Operational ABM (OABM)

Do things right:把事情做对

• Pricing the product based on ABC cost.

• Activities which add value to a product are identified and improved.

• Activities that don't add value to the product can be removed to cut costs without reducing product value.

• R&D to simplify process and production so that cost can be reduced.

Applying ABM

Re-price products.

Reduce costs.

Decision making – Which product to sell or customers to serve.

13 BPR:Business Process Re-engineering--业务流程重组

- The fundamental rethinking and radical redesign of business processes to achieve dramatic improvements in critical, contemporary measures of performance, suchas cost, quality,service and speed.

2-Improved customer satisfaction is often the primary aim.

How can BPR help improve performance?

- Breaking functional boundaries → team work to improve quality, costs, speed and services→ improving customer satisfaction

- Culture change to support the changing relationship between employees → training tosupport culture change

-IT and IS to support information flowPMS need to address team-work and reward to be attached to achievement of team targets.

14 Value chain-价值链 The value chain is to create value via activities.是通过活动创造价值。

The value chain is to create value via activities.

-Value chain analysis helps identify the activities which create value for its customers toimprove.

- Activities in the value chain affect one another → to co-ordinate.

1 How can Value Chain help improve performance

- The value chain uses activities rather than traditional functional departments (such asfinance) to describe the business, emphasising that it is activities which create value andincur costs.

- The activities are split into two groups: primary ones which the customer interacts withdirectly and can 'see' the value being created and secondary ones which support the primaryactivities. The business can then identify how value is created and so focus on improvingthis through its performance measurement system.

- Another important feature of the value chain is the idea of value creation through a chainlinking activities to each other. Therefore, there must be a flow of information between thedifferent activities and across departmental boundaries.

- Implications on perf mgmt: Focusing on how activities are creating value. Rewards to be set for value creation. The information systems will have to ensure good communication across functionalboundaries.

15. mckinsey7s模型---

To evaluate whether company A is properly aligned with company B in 7S

是麦肯锡顾问公司研究中心设计的企业组织七要素,指出了企业在发展过程中必须全面地考虑各方面的情况,

1.Strategy(战略):企业制定的长期规划和目标,包括市场定位、产品定位、经营理念等。战略是企业的方向和目标,是企业实现长期发展和成功的重要保障。

2.Structure(结构):企业的组织架构和运营模式,包括职责划分、授权、协同等。结构是企业的基础,它直接影响着企业的决策效率、执行效率和协同效率。

3.Systems(系统):企业的各种管理系统,包括财务、人力资源、信息技术等。系统是企业的支撑,它直接影响着企业的管理效率、资源利用效率和信息化水平。

4.Style(风格):企业的管理风格,包括领导风格、企业文化等。风格是企业的气质,它直接影响着企业的凝聚力、创新力和竞争力。

5.Staff(员工):企业的员工队伍,包括数量、素质、培训等。员工是企业的基石,他们的素质和能力直接决定着企业的质量和效率。

6.Skills(技能):企业的核心业务和技术能力,包括研发、生产、销售等。技能是企业的核心竞争力,它直接影响着企业的市场地位、品牌价值和盈利能力。

7.Shared Values(共享价值观):企业的核心价值观和文化,包括企业使命、价值观、社会责任等。共享价值观是企业的灵魂,它直接决定着企业的品牌形象、社会声誉和企业家精神。

These 'hard' elements are easily quantified and defined, and deal with facts and rules.

Structure. The organisation structure refers to the formal division of tasks in theorganisation and the hierarchy of authority from the most senior to junior.

Strategy. How the organisation plans to outperform its competitors, or how it intends toachieve its objectives. This is linked to shared values.

Systems. These include the technical systems of accounting, personnel, management information and so forth. These are linked to the skills of the staff.

'Soft' elements are equally important.

Style refers to the corporate culture that is the shared assumptions, ways of working,attitudes and beliefs. It is the way the organisation presents itself to the outside world.

Shared values are the guiding beliefs of people in the organisation as to why it exists. (Forexample, people in a hospital seek to save lives.)

Staff are the people in the organisation.

Skills refer to those things that the organisation does well.

16 . Environmental management accounting (EMA)

The generation and analysis of both financialand non-financial information in order to support internal environmental management processes'.

Environmental costs based on costs of quality

Environmental prevention cost-Costs incurred to protect the environment.

Insulation of heating pipes in the factory to reduce heat loss

Fitting of carbon filters to machine processes to reduce carbon emissions

Environmental detection costs-Costs incurred to test the levels of emissions and wastage to ensure that the organisationis being compliant with internal standards and external regulations.

Quality control inspections to monitor pollution levels in water leaving a productionprocess

Power usage measuring system to monitor energy consumption within the factory

Environmental failure cost- Costs of dealing with pollution or wastage

. Environmental internal failure costsCosts to dealt with pollution or wastage within the organisation before it affects theexternal environment.➢ Water purification treatment to clean wastewater before it leaves the factory➢ Recycling of waste exhaust gases to generate energy

Environmental external failure costsCosts relate to pollution which has affected the outside environment.➢ Payment of fines for breaching environmental regulations in the industry➢ Public relations costs to remedy reputational damage caused by accidental riverpollutionEnvironmentalcostsConventional costs, such as raw material costs and energy costs.Hidden cost, such as cost of waste through inefficiency.Contingent costs such as the cost of cleaning industrial siteswhen these are decommissioned.Relationship/Reputational costs include, such as, the costs ofproducing environmental reports, lost contribution due tobusiness actions causing ham to the environment

17 Lean Management - To remove waste and to add value ← get right things at the right time and right place.

精益管理-消除浪费,增加价值← 在正确的时间、正确的地点做正确的事情。

Lean management system – The IS to provide right info to right people at right time.

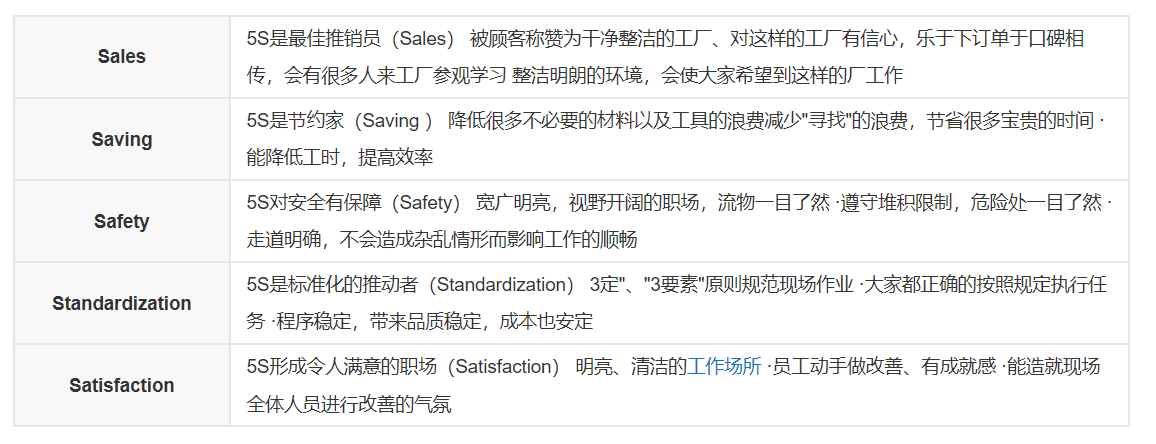

The five S's concept → To evaluate whether the workplace/the IS is in order ← - waste, +efficiency

Structurise – Introduce order where possible, EASY to FIND (categories, need or not?).

Systemise➢ Necessary items are arranged at required places and quantities according to theorders introduced. EASY for USE → Save time (reduce waste) to look for items,improve efficiency, quality and reduce accidents.➢ IT/IS: The new RFID system will help to arrange and identify items, computer terminalsand networks to be set up.

Sanitise - Be tidy, remove any unnecessary obstacles on site.

Standardise - Be consistent in the approach taken.

Self-discipline - Maintain through motivation

5S的定义与目的:5S就是整理(SEIRI)、整顿(SEITON)、清扫(SEISO)、清洁(SEIKETSU)、素养(SHITSUKE)五个项目

5S的效用:

18 Enterprise Resource Planning (ERP) Systems

ERPS are groups of software applications integrated to form enterprise-wide information systems.

⚫ The aim was that one system would serve the whole organisation.

It leads to less duplication of data, which means less time is wasted entering informationinto two or more systems and reconciling information from different systems.

Senior managers have access to all the data in one place, rather than information being spread among separate systems. This enables managers to have a clearer knowledge of what is happening.

Salesmanager

• By knowing exactly the real time data of sales, can compare performanceof the product with target and past sales.

• External data included in ERPS may allow sales manager to understand themarket condition so that he/she can make prompt response to customer'demands, e.g. which product might be discounted and to what level.

Inventorymanagement

• The manufacturing system will be linked into the purchase system andinventory control system, for example, to ensure that inventory levels aresufficient to support planned production.

• Minimum inventory level is set up in the system so that ordering will betriggered when inventory reaches that level. This helps avoid problemsfrom employees not entering the purchase order into the computer systemand ensure that the relevant people in the organization are fully aware ofthe inventory both on order and in store.Supplierrelationshipmanagement

• Details of the deliveries can be tracked and the ERPS will enable staff atappropriate level to discover how long deliveries are taking and to managethe supplier relationship accordingly.

19. Characteristics of Big Data --大数据的特点

Big Data is 'datasets whose size is beyond the ability of typical database software to capture,store, manage and analyse'.

Volume: the ability to process very large amounts of information.

Velocity: Refers to the increasing speed with which data flows into an organisation, and with which it is processed within the organisation.

Variety (or variability) : the diversity of source data, with a lot of the data beingunstructured (i.e. not in a database).

Veracity (truthfulness)

Value

The characteristics of big data, known as the 5Vs, are:

Volume-The volume of big data held by large companies such as Walmart (supermarkets), Apple and EBay is measured in multiple petabytes.

Variety-

Browsing activities: sites, pages visited, membership of sites, downloads, searches

Financial transactions

Interests

Buying habits

Reaction to advertisements on the internet or to advertising emails

Geographical information

Information about social and business contacts

Text

Numerical information

Graphical information (such as photographs)

Oral information (such as voice mails)

Technical information, such as jet engine vibration and temperature analysis

T

his data is stored within defined fields (numerical, text, date etc) often with defined lengths, within a defined record, in a file of similar records.Velocity-nformation must be provided quickly enough to be of use in decision-making and performance management.

Veracity-means accuracy and truthfulness and relates to the quality of the data.

Value-The last V of big data (although some models have added more) is Value

T

The processing of big data is generally known as big data analytics and includes:

Data mining: analysing data to identify patterns and establish relationships such as associations (where several events are connected), sequences (where one event leads to another) and correlations.

Predictive analytics: a type of data mining which aims to predict future events. For example, the chance of someone being persuaded to upgrade a flight.

Text analytics: scanning text such as emails and word processing documents to extract useful information. It could simply be looking for key-words that indicate an interest in a product or place.

Voice analytics: as above but with audio.

Statistical analytics: used to identify trends, correlations and changes in behaviour.

20. EVA Economic value added --经济增加值

EVA is an estimate of true economic profit after making corrective adjustments to GAAPaccounting.

Principles of EVA

- Assets once created cannot be diminished by accounting actions.

- Investment leads to assets regardless of accounting treatments.

Calculating EVA

EVA = Net operating profit after tax (NOPAT) - Capital employed x Cost of capital

NOPATPAT (I/S)

Add: Tax charged (I/S)

Less: Tax paid+ Interest after tax+ Accounting depreciation- Economic depreciation+ Goodwill AMORTISED+ Increase of doubtful debt / (Decrease of doubtfuldebt)+ Non-cash expenses+ Increase of R&D / (Amortised R&D)+ Operating lease expense / (Economic Depreciation)- Goodwill impairmentNOPATNOPAT = PBIT * (1 – t)NOPAT = PBIT-i*t–Tax paid

21. Capital employed

Opening Bal. of Total assets (NCA + CA) in the B/S

Minus: non-interest-bearing activities (e.g. A/P, tax payables)Adjustments:NBV of tangible NCAs + accumulative accounting Deprn’ – accumulative economic Deprn’

Add: Non-cash expenses (Opening figure)

Cumulative amortised GW (Opening figure)

NBV of Provision of doubtful debts (Opening figure)

NBV of development costs to be capitalised (Opening figure)

PV of operating lease costs to be capitalised (Opening figure)

Adjusted Capital invested

22. Transfer pricing--TP

A transfer price is the price at which goods or services are transferred from one division to another within the same organization.

Objective of a transfer pricing system (Why using a formal transfer pricing system?)

- Reducing time to argue on prices between divisional managers. More time to spend on other issues therefore.

-Autonomy and goal congruence

No autonomy → demotivating divisional managers.

With autonomy → possibility of making sub-optimal decisions.

Formal TP system → to maintain autonomy & to avoid dysfunctional behavior → org profitmaximised

-A good transfer price would enable each centre to be evaluated on the basis of profit.

- Cost centre If the seller is a cost centre, it is motivating for buyers to pay at seller’s costs.

1 Market price

Where there is a perfectly competitive market for an intermediate product

⚫ A perfect market means that there is only one price in the market

⚫ There are no buying or selling costs and

⚫ Care must be taken to ensure the division's product is the same as that offered by themarket (e.g. sizes, quality, delivery terms, etc.).

⚫ The market price should be adjusted for costs not incurred on an internal transfer.5.2.2 Cost-based Price

⚫ The selling division has surplus capacityMarginal cost of the supplying division ≤ Transfer price ≤ External purchase price ofbuying division

⚫ The selling division has no surplus capacityMarginal cost of the supplying division + Lost contribution from other product ≤ Transferprice ≤ External purchase price of buying divisionPros of MP Cons of MP1) Equivalent price → making decisions2) Equivalent price → fair to both divisions3) Equivalent price → reducing time taken to argue on the TP4) Encouraging seller to improve efficiency5) Buyer gets better services and quality from internal transfer6) Avoidable costs removed → benefit may be shared to bothparties7) No selling and purchasing costs, saving costs for thecompany → Goal congruence1) No equivalent prices2) Temporary prices →changing TP, timeconsuming, confusing themgrs3) Difficult to agree onavoidable costsTransfer price = market priceTransfer price = market price – avoidable costs

23. Features of NFPIs

Pros

• Long-term focused/Leading info•

• External factors concerned•

• May be less likely to be manipulatedthan financial indicators•

• Are easy to understand, especiallyfor non-financial managers•

Cons

• Soft issues difficult to quantify

• Definitions are subjective

• Customer data difficult to collect andinterpret

• Not audited like financial data

• May not be accurate/reliable ← no matter theinfo is from internal source or externalsources

24. League table--排名表

The use of league tables helps benchmark performance as measures and targets areclearly set up when designing the table. League tables give a clear and immediate answerto questions of relative performance using the rank in the table

Advantages League table

• Clear targets set based on how performance is measured and assessed.

• Stimulates competition and the adoption of best practice → the quality of the service shouldimprove.

• Monitors and ensures accountability of the providers.

• Performance is transparent → more choices for information users? (e.g. selecting a schoolaccording league table results)

Weaknesses of league table

• Relative performance is better ≠ better performance in absolute terms.

• When comparing NPOs' performance in different countries: Different countries, government policies may affect what should be managed andmeasured in the specific situations.➢ Measures used may not all be specifically linked to each NPO's objectives?➢ Weightings in the formula affects managers' decisions? → objectives?

•Copying league table from other country or other NPOs may not be suitable no. of KPIsshould be used? Decisions of info users?

• League table → behaviour Measured, done. Not measured, not done. Measured, not controllable not accountable.

25. JIT--just in time

is based on the Kaizen philosophy of continuous improvement.

⚫ Pull system – respond to demand each component is produced only when needed.

The Impact of JIT on Performance Management:

⚫ Inventory counting – The inevitable reduction in inventory levels will reduce the time takento count inventory and the clerical cost.

⚫ IS – IS design to support inventory management, especially communication betweendepartments and, with suppliers and customers.

⚫ Changes in purchasing Selecting suppliers Suppliers' desire to JIT supplies (Suppliers' operations) No. of suppliers is reduced → reducing time for discussions and easy to improverelationship with suppliers Defects-free from suppliers → delivering right items at right time to customers On-going supplier audit

⚫ Changes in production→ To supply right items at right time Quality➢ Customers' quality level is mutually understood.➢ Increasing prevention and appraisal cost → reducing failure costs (both IFC & EFC).➢ Improved by team members staff are grouped by orders and together, they areresponsible for quality of the orders. Quantity➢ Multi-skilled team members to reduce bottleneck and unnecessary cost, e.g.supervisor cost is no longer needed.➢ changing factory layouts to allow team flexibility.➢ Staff training and culture change to allow multi-skills staff capable to identifydefective goods and to avoid further processing them → +quantity & Lead time Bonus → quality measures, e.g. defects detected, zero error, lead time

2 Problems which will accompany a move towards just-in-time manufacturing

⚫ Demand forecasted accurately? close relationship with customers

⚫ Price and delivery term and quality? detailed supply chain analysis to locate 'right'suppliers

⚫ To reduce supplier numbers → + suppliers' power → supply chain disruption?

⚫ Mind-set? Training? Factory layout for flexibility?

26. Target costing is a pro-active cost control system. Its purpose is to reduce cost continuously.

目标成本法是一种主动的成本控制系统。其目的是不断降低成本

Steps of target costing:

27. Kaizen costing--成本制度

•Using small, incremental changes routinely applied and sustained over a long period resultin significant improvements.•Kaizen costing has been developed to support the continued cost reduction of existingcomponents and products (after R&D).

Reducing waste after R&D --> -cost,updating cost target once it is achieved,team --> quick response to problems,continuous improvement, small &incremental changes routinely --> notsuitable for products with short LC

How can Kaizen help improve performance?

- Reducing waste Focuses on eliminating waste in the targeted systems and processes of an organization,improving productivity, and achieving sustained continual improvement. KPIs to reflectwaste reduction.

-Team-work Aims to involve workers from multiple functions and levels in the organization in workingtogether to address a problem or improve a particulate process. Training staff toparticipate in and contribute to team-work.

- Cost target Cost reduction targets are set and applied on a more frequent basis than standard costs.

- Empowered staff to react quickly without large capital expenditure.

- IS to support (team communication, real-time cost data)

- It takes longer time to achieve a dramatic improvement, does not help if the project/p roductis with a short life cycle.

28. TQM --Total Quailty Management 全面质量管理

是一个将所有集团的质量管理工作整合在一起的系统。

-TQM is a system which integrates the quality management efforts of all groups in anorganisation.

- The basic principle of TQM is that costs of prevention (getting things right first time) are lessthan the costs of correction.

Impacts on perf. Mgmt:

- Involvement of everyone in the organisation in continually improving the processes andsystems under their control → Culture change.

- An investment in training and education to realise individual potential.

- Teamwork in a number of forms such as quality circles → To effectively use prevention coststo reduce failure costs.

- IS to support departmental communication for better understanding effectiveness of thequality initiatives.

- Target setting for zero defect.

- Continuous improvement → Reducing cost continuously.

- Suppliers and customers forming an integrated part of the process of improvement.

- Ensuring that quality factors have been correctly engineered into the design of products.

- Process re-design - to simplify processes, procedures and the organisation.

29. Six capitals involved in value creation:

6 sigma⚫ It is designed to decrease wastage and improve products and services, leading to greatercustomer satisfaction and lower costs.⚫ Error target – there are no more than 3.4 defects per million opportunities – the SixSigma (6σ) level of performance. (Error rates ≤ 0.00034%)⚫ Defining defects (errors) – performance targets are based on customer requirements.

Financial capital

Manufactured capital

Human capital

Intellectual capital

Natural capita

l Social and relationship capital

The Six Sigma is a framework which makes use of a range of tools, such as:

- Fishbone diagrams

- Process mapping tools

- SWOT analysis

- Pareto analysis

The Five Steps Of The Six Sigma Process

-Define: defining the problem, clarifying the purpose of the project and identify customerr equirements

- Measure: data collection to quantify the problem and causes, measuring the key processes which are critical to quality

- Analyses: analysis of data to find the root cause of the problem.

- Improve: developing solutions and implementing them

- Control: monitoring changes and dealing with problems arising. The control process willfocus on key performance measures.

30. Management styles

Hopwood identified three distinct management styles of performance appraisal:

31. The performance pyramid 塔形分解

The performance pyramid was developed:

to understand and define the links between objectives and performance measures at different levels in the organisation;

to ensure that the activities of every department, system and business unit support the overall vision of the organisation.

How the Pyramid model can help companies achieve its vision?

(Pros of the model)

It helps to set financial and non-financial performance measures ➡ holistic view of perf

Non-financial perf indicators will lead to long-term financial sustainability

Objectives cascade down the pyramid from the strategic to the operational level. The elements of the pyramid are interrelated, and each level in the pyramid supports the oneabove it.

The pyramid ensures that all aspects, both internal and external, of performance are measured.

32. Fitzgerald's and Moon's building block model--Fitzgerald和Moon的积木模型

ctivity-Based Costing and Control将企业的各项活动分解成若干个基本活动,然后通过对这些基本活动的成本和效益进行分析,确定企业的战略和管理方针。

1.战略层次:确定企业的战略目标和方向,包括市场定位、产品定位、成本控制等。

2.过程层次:将企业的各项活动分解成若干个基本活动,然后对这些基本活动进行成本和效益分析。

3.操作层次:根据过程层次的分析结果,制定具体的管理措施和操作方法,实现企业目标的落实。

The Building Block model looks at three areas of performance:

dimensions

Companies compete across a range of dimensions besides financial performance. The Building Block model considers this and describes two categories of dimensions: ‘Results’ and ‘Determinants.’

‘Results’ are the outcome of decisions and actions taken by management in the past. These are captured under the first two dimensions of the model, financial performance and competitiveness.

‘Determinants’ refer to the forward-looking dimensions of the model: what areas of future performance are most important for a company to achieve positive financial and competitive results? Quality, innovation, flexibility and resource utilization are the determinants of future success.

standards-- After an organisation’s dimensions are understood, standards can be set.

Who is responsible for achieving the standard (ownership)?

What level are the standards set at (achievability)?

Can we use the standards for a fair appraisal across the company (equity)?

rewards-- The last part of the model looks at the overall reward structure of the organisation and is the link to HR systems.

Is the system understandable to all employees (clarity)?

Will the system drive employees to achieve their objectives (motivation)?

Do employees have control over their areas of responsibility (controllability)?

Like other modern performance measurement frameworks, the Building Block model connects an organisation’s strategic objectives to a range of forward-looking, non-financial performance measures. Where the Building Block Model differs, however, is that also considers reward systems and aims to create a framework of clearly understood and communicated individual metrics that aligns individual performance targets with organizational objectives.

33.Network (virtual) structure

Problems of Measurement

Not on-site → Difficult to observe their dedication to works (effort and outcomes)IT/IS to collect performance data automaticallye.g. Staff log-in org's IS to work

Log-in hours (input or effort of staff)However, productivity (outcomes) difficult to define and monitorStaff computers HW and SW must be compatible

Strategic partners

Collecting data relying on IS → IS not compatible, data processed with differentformats and methods → wasting time to reconcile data and interpret data →Arguments on perf

Conflicts of objectives → Arguments on acceptable level of perf (targets)Org: +quality → +Q & profitPartner: -cost → +profitQuality level to be agreed

Problems of perf mgmt

Staff:

perf mgmt :Staff not on site, reducing travellingtime, more family time, more flexiblehoursOrg: Difficult to motivate staff toachieve desired output

Solutions :

Clearly defining input and output of staff measures to quantify and motivate perf Log-in hours, Project-based output RewardsTo communicate with staff about rewardsand the measurement system

Strategic partners

perf mgmt :Org: How to motivate partners to have goal congruence:

Org: How to motivate partners to have goal congruence:1. Conflicts1. To encourage partners to improvequality so that sales volume and profitcan be improved. Shared profit withpartners2. Relying on partners.Taking time to replace and affectingcustomer satisfaction.2. Relationship mgmt To reducedisputes and disagreements aboutperformance Mutual trust Clearcontract terms dictate outcomes (SLAs)3. IS (EDI) to contact with partners forquick response to customer needs →Confidential data to be leaked? E.g.Customer and supplier data3. To protect confidential data e.g. withclear contract terms for penalty

34.JV (Joint Venture)Difficulties in measuring and managing performance of a JV

Difficulties in measuring performance of a JV

• Difficult to measure contribution from eachparty

• Confidential data Design, productionefficiency (commercial sensitive)• Different IS → taking time to integrate andinterpret data

35. Approaches of budgeting

- Fixed and flexed budget

- Incremental budgets

- ZBB-Zero-based-budget

- Rolling budgets

- ABB-Activity-Based-Budget

Purpose of budgeting --A budget is a quantitative plan prepared for a specific time period. It is normally expressed in financial and non-financial terms and prepared for one year.

- Purposes:- Planning- Control- Communication-Evaluation- Motivation

36. Value for money (VFM)--货币价值

the approach which is used for the evaluation/assessment of the workof especially non-profit enterprises and it consists of analysing 3 E:

Economy – the optimisation of the resources which the organisation has; ensuring theappropriate quality of input resources are obtained at the lowest cost;

Efficiency – the optimisation of the process by which inputs are turned into outputs;

Effectiveness – how the outputs of the organisation meet its goals.

37. Benchmarking (BM)

Best practices are used to compare performance to learn & improve.

Competitor BM -To Competitor:

- Improvements to be made with a similar business.

- However, only valuable when competitors demonstrate competitive advantages.

- It does not identifyhow to gain advantage over therivals.

- Difficult to obtaininfo.

- Even if a competitorcan be persuaded toshare information, itwill often only givestrategicimprovements, notoperational ones

Functional BM -Similar function inanother industry,e.g. logistics

- However, it isdifficult totranslate lessonsfrom one industryto another.

- Could share detailed operational data without the worry of loss of confidential information directly to acompetitor. However, different IS tocollect data makes the use of info challenging.

Internal BM -Internal divisions

-Improvements within thesame organization, e.g.business integration.

- Detailed operational information. However,non-financial info production is less robustthan financial ones andinvolves subjectivejudgments.

- Ignore competitor performance, may not beworld leading.

However, it is suitable for companies to use this approach as a one-off exercise, to harmon iseand improve the divisions' performance.

⚫ Difficulties & limitations of Benchmarking

- Costly and time-consuming.

- Other organisation may be unwilling to share information, particularly non-financiali nformation about competitors.

- Benchmarking information must be interpreted carefully to ensure that organisations are generalising reasonable conclusions:

Differences in the way that data is produced could detriment the comparison.

The business functions being benchmarked must be similar enough to allow meaningful comparison.

Exchange rate impacts could confuse the comparison.

Impacts from different economic and market conditions between organisations.

Not real-time data: 20X7 data can not predict performance in 20X8.

- Does not tell how to improve performance.

38. Stakeholder analysis

Mendelow's Matrix

39. Performance management information systems (PMIS)

IS to provide management info ➡ Must be matched with info requirements

Factors affecting info requirements/info to be provided: :

• Easy to understand

• Easy to use for comparisons

• Timely

• Accurate → human errors

• Reliable

• Relevant to users ← functional dept, responsibilitycentres

• Controllability

• Not overloading

• Backups

• Communication channel

• Frequency of reporting•

Cost-effectiveness

• Details

• Internal and/or external info

• Short-term and/or long-term info

• Quantitative and/or qualitative

40. Sources of management information

1 Internal sourcesInternal sources of information may be taken from a variety of areas such as the sales ledger,payroll system and/or fixed asset system.

2 External sourcesIn addition to internal information sources, there is much information to be obtained fromexternal sources. For example from suppliers, customers and the government.

- Not reliable?

- Subjective?

- Difficult to gather e.g. from customers or competitors

- Non-structured?

- Out of date?

- May not meet the exact needs of the company

- Costs?

41. Performance reports

To evaluate a performance report:

Aim of the report

Break down and prioritise themission/strategies

Measurement of objectives (KPIs →Mission)

Useful info to support strategic decisionmaking:

• FPIs + NFPIs, S-T + L-T, Internal +external, divisional + organisational, relative+ absolute

• Backward (controlling) + forward looking(planning)

Presentation:

•Clear structure? Not overloading?

• Detailed or summarised? Rounding?

• Commentary – Explanation theperformance in relation to objectives➢ Numbers➢ Non-numerical issues

42. Nature of info 信息性质

43. Integrated reporting (IR) 综合报告

Integrated reporting has a focus on opportunities and risk, how resources are allocated and performance both recent historic and expected in the future.

There is no standard format for integrated reporting.

Six capitals involved in value creation:

Financial capital

Manufactured capital

Human capital

Intellectual capital

Natural capital

Social and relationship capital

44. Data warehouse & data mining

⚫ A data warehouse is a type of data management system that is designed to enable andsupport business intelligence (BI) activities, especially analytics.

⚫ The data within a data warehouse is usually derived from a wide range of sources such asapplication log files and transaction applications.

⚫ Data warehouses often contain large amounts of historical data.

⚫ Data mining involves seeking relationships, for example, geographical preferences forproducts; links between price offers and volumes sold; products which are often boughttogether; seasonality of product purchases.

45. RFID--It allows organisations to keep track of assets by tagging them with small radio transmitters(RFID tag).

Benefits:

Tracking the movement of the tagged items

Real-time count of items

Checking whether the items are at the secured places

Quick decision on inventory movement (e.g. items close to expiry date to be issued outfirst)

46. Customer relationship management (CRM)

CRM systems help the organisation to know their customers better and to use thatknowledge to serve customers better.

They enable a business to manage its relationshipcentrally through the storage of existing and potential customer contact information.

47. Knowledge management system (KMS)

is a relatively new approach to business in which an organisationgathers, organises, shares and analyses its knowledge to further its aim.

⚫ Knowledge resides in:

Human capital – the knowledge, skills and experience possessed by employees,suppliers and customers.

Structural capital – includes intellectual capital (e.g. patents) and client information (e.g.address lists and client records).

⚫ Knowledge management systems (KMS) aim to manage the knowledge that theorganisation has. The aim of the systems is to store the information and share it, so it isavailable to other members of staff when they need it.

48.. Measuring divisional manage performance

EBITDA - Assessment of earnings before interest tax, depreciation and amortisation

49. Life cycle costing

Life cycle costing measures all costs and revenue of each project over the complete life cycle of the project,

Drawbacks of AI:

Customers may react adversely to interactions with technology.

AI systems may operate in a way that is not predicted so some controls over AI behaviourmay be useful.

AI systems may be ignored or misused by human operators if they do not explain theircourse of action.

If AI systems only use data generated within a business, they will be less effective atlearning as big data should be sourced to learn.

The management of human resources (HRM)

•Recruitment• No. of vacancies unfilled• No. of qualified staff employed• Salary per staff compared with industry average

•Motivation• Output/hour• Salary per staff compared with industry average• Absenteeism, which can give an indication of the morale of employees.• Turnover rates, which should be further analysed to identify the reasons forleaving.

•Resourceutilisation• Sales per staff

•Retainingstaff• Staff retention rate• Staff turnover rate

Seven main types of waste:

1. Over-production: produce more than customers have ordered

2. nventory: holding or purchasing unnecessary inventory

3. Waiting: production delays/idle time when value is not added to the product

4. Defective units: production of a part that is scrapped or requires rework

5. Motion: actions of people/equipment that do not add value

6. Transportation: poor planning or factory layout results in unnecessary transportation ofmaterials/WIP

7. Over-processing: unnecessary steps that do not add value

• Artificial intelligence (AI)

• Data Protection Regulation (GDPR)

T• he International Integrated Reporting Council (IIRC)

上一条:认股权证的特征相用途

下一条:企业财务管理